Linear regression¶

This method deals with the parametric modelling of a probability

distribution for a random vector

. It aims to measure

a type of dependence (here a linear relation) which may exist between a

component

and other uncertain variables

.

The principle of the multiple linear regression model is to find the

function that links the variable to other variables

,…,

by means of a linear model:

where describes a random variable with zero mean

and standard deviation

independent of the input variables

. For given values of

,…,

,

the average forecast of

is denoted by

and is defined as:

The estimators for the regression coefficients

, and the

standard deviation

are obtained from a sample of

, that is a set of

values

,…,

.

They are determined via the least-squares method:

In other words, the principle is to minimize the total quadratic

distance between the observations and the linear forecast

.

Some estimated coefficient may be close to

zero, which may indicate that the variable

does not

bring valuable information to forecast

. A classical statistical

test to identify such situations is available: Fisher’s test.

For each estimated coefficient

, an important

characteristic is the so-called “

-value” of Fisher’s test. The

coefficient is said to be “significant” if and only if

is greater than a value

chosen by the user (typically 5% or 10%). The higher the

-value, the more significant the coefficient.

Another important characteristic of the adjusted linear model is the

coefficient of determination . This quantity indicates the

part of the variance of

that is explained by the linear

model:

where denotes the empirical mean of the sample

.

Thus, . A value close to 1 indicates a good fit

of the linear model, whereas a value close to 0 indicates that the

linear model does not provide a relevant forecast. A statistical test

allows to detect significant values of

. Again, a

-value is provided: the higher the

-value, the more

significant the coefficient of determination.

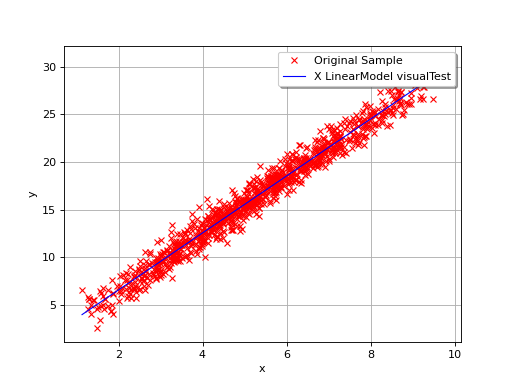

By definition, the multiple regression model is only relevant for linear

relationships, as in the following simple example where

.

(Source code, png, hires.png, pdf)

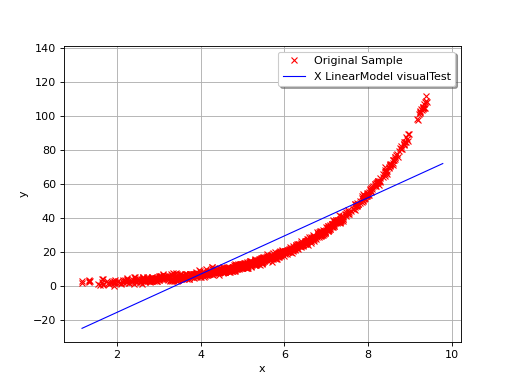

In this second example (still in dimension 1), the linear model is not

relevant because of the exponential shape of the relation. But a linear

approach would be useful on the transformed problem

. In other words, what is important is

that the relationships between

and the variables

,…,

is linear with respect to the

regression coefficients

.

(Source code, png, hires.png, pdf)

The value of is a good indication of the goodness-of fit of

the linear model. However, several other verifications have to be

carried out before concluding that the linear model is satisfactory. For

instance, one has to pay attentions to the “residuals”

of the regression:

A residual is thus equal to the difference between the observed value

of and the average forecast provided by the linear model. A

key-assumption for the robustness of the model is that the

characteristics of the residuals do not depend on the value of

: the mean value should be close

to 0 and the standard deviation should be constant. Thus, plotting the

residuals versus these variables can fruitful.

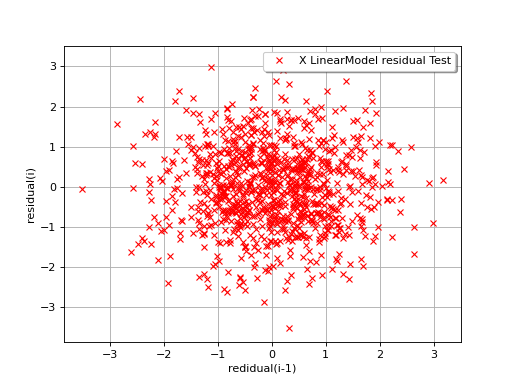

In the following example, the behavior of the residuals is satisfactory: no particular trend can be detected neither in the mean nor in he standard deviation.

(Source code, png, hires.png, pdf)

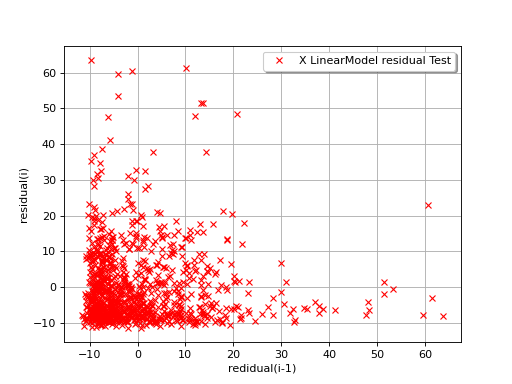

The next example illustrates a less favorable situation: the mean value

of the residuals seems to be close to 0 but the standard deviation tends

to increase with . In such a situation, the linear model should

be abandoned, or at least used very cautiously.

(Source code, png, hires.png, pdf)

API:

See

LinearModelAlgorithmto build a linear modelSee

LinearModelResultfor the associated resultsSee

VisualTest_DrawLinearModel()to draw a linear modelSee

VisualTest_DrawLinearModelResidual()to draw the residualSee

LinearModelTest_LinearModelFisher()to assess the nullity of the coefficientsSee

LinearModelTest_LinearModelResidualMean()to assess the mean residualSee

LinearModelTest_LinearModelHarrisonMcCabe()to assess the homoscedasticity of the residualSee

LinearModelTest_LinearModelBreuschPagan()to assess the homoscedasticity of the residualSee

LinearModelTest_LinearModelDurbinWatson()to assess the autocorrelation of the residual

Examples:

OpenTURNS

OpenTURNS