Estimating moments with Monte Carlo¶

Let us denote

,

where

is a random

vector, and

a deterministic vector. We seek here to

evaluate, the characteristics of the central part (central tendency and

spread i.e. mean and variance) of the probability distribution of a

variable

, using the probability distribution of the random

vector

.

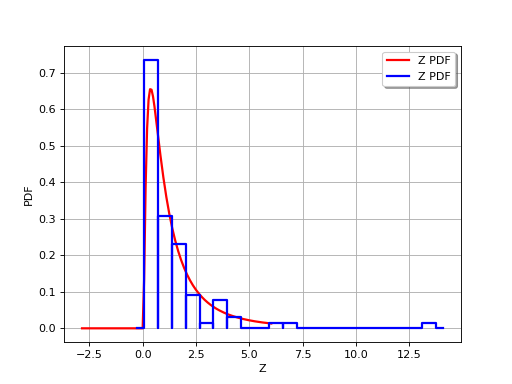

The Monte Carlo method is a numerical integration method using sampling,

which can be used, for example, to determine the mean and standard

deviation of a random variable (if these quantities exist,

which is not the case for all probability distributions):

where represents the probability density function of

.

Suppose now that we have the sample

of

values randomly

and independently sampled from the probability distribution

; this sample can be obtained by drawing a

sample

of the

random vector

(the distribution of which is known) and

by computing

.

Then, the Monte-Carlo estimations for the mean and standard deviation

are the empirical mean and standard deviations of the sample:

These are just estimations, but by the law of large numbers their

convergence to the real values and

is assured as the sample size

tends to infinity. The Central

Limit Theorem enables the difference between the estimated value and the

sought value to be controlled by means of a confidence interval

(especially if

is sufficiently large, typically

> a few

dozens even if there is now way to say for sure if the asymptotic

behavior is reached). For a probability

strictly between

and

chosen by the user, one can, for example, be sure with a

confidence

, that the true value of

is

between

and

calculated analytically from simple formulae. To illustrate, for

:

The size of the confidence interval, which represents the uncertainty

of this mean estimation, decreases as increases but more

gradually (the rate is proportional to

: multiplying

by

reduces the length of the confidence interval

by a

factor

).

This method is also referred to as Direct sampling, crude Monte Carlo method, Classical Monte Carlo integration.

(Source code, png, hires.png, pdf)

OpenTURNS

OpenTURNS