ANCOVA¶

- class ANCOVA(*args)¶

ANalysis of COVAriance method (ANCOVA).

Refer to Sensivity analysis with correlated inputs.

- Parameters:

- functionalChaosResult

FunctionalChaosResult Functional chaos result approximating the model response with uncorrelated inputs.

- correlatedInput2-d sequence of float

Correlated inputs used to compute the real values of the output. Its dimension must be equal to the number of inputs of the model.

- functionalChaosResult

Methods

getIndices([marginalIndex])Accessor to the ANCOVA indices.

getUncorrelatedIndices([marginalIndex])Accessor to the ANCOVA indices measuring uncorrelated effects.

Notes

ANCOVA, a variance-based method described in [caniou2012], is a generalization of the ANOVA (ANalysis Of VAriance) decomposition for models with correlated input parameters.

Let us consider a model

without making any hypothesis on the dependence structure of

, a n_X-dimensional random vector. The covariance decomposition requires a functional decomposition of the model. Thus the model response

is expanded as a sum of functions of increasing dimension as follows:

(1)¶

is the mean of

. Each function

represents, for any non empty set

, the combined contribution of the variables

to

.

Using the properties of the covariance, the variance of

can be decomposed into a variance part and a covariance part as follows:

This variance formula enables to define each total part of variance of

due to

,

, as the sum of a physical (or uncorrelated) part and a correlated part such as:

where

is the uncorrelated part of variance of Y due to

:

and

is the contribution of the correlation of

with the other parameters:

As the computational cost of the indices with the numerical model

can be very high, [caniou2012] suggests to approximate the model response with a polynomial chaos expansion:

However, for the sake of computational simplicity, the latter is constructed considering independent components

. Thus the chaos basis is not orthogonal with respect to the correlated inputs under consideration, and it is only used as a metamodel to generate approximated evaluations of the model response and its summands (1).

The next step consists in identifying the component functions. For instance, for

:

where

is a set of degrees associated to the

univariate polynomial

.

Then the model response

is evaluated using a sample

of the correlated joint distribution. Finally, the several indices are computed using the model response and its component functions that have been identified on the polynomial chaos.

Examples

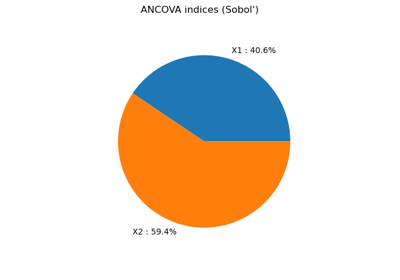

>>> import openturns as ot >>> ot.RandomGenerator.SetSeed(0) >>> # Model and distribution definition >>> model = ot.SymbolicFunction(['X1','X2'], ['4.*X1 + 5.*X2']) >>> distribution = ot.JointDistribution([ot.Normal()] * 2) >>> S = ot.CorrelationMatrix(2) >>> S[1, 0] = 0.3 >>> R = ot.NormalCopula().GetCorrelationFromSpearmanCorrelation(S) >>> CorrelatedInputDistribution = ot.JointDistribution([ot.Normal()] * 2, ot.NormalCopula(R)) >>> sample = CorrelatedInputDistribution.getSample(200) >>> # Functional chaos computation >>> productBasis = ot.OrthogonalProductPolynomialFactory([ot.HermiteFactory()] * 2, ot.LinearEnumerateFunction(2)) >>> adaptiveStrategy = ot.FixedStrategy(productBasis, 15) >>> experiment = ot.MonteCarloExperiment(distribution, 100) >>> X = experiment.generate() >>> Y = model(X) >>> algo = ot.FunctionalChaosAlgorithm(X, Y, distribution, adaptiveStrategy) >>> algo.run() >>> ancovaResult = ot.ANCOVA(algo.getResult(), sample) >>> indices = ancovaResult.getIndices() >>> print(indices) [0.408398,0.591602] >>> uncorrelatedIndices = ancovaResult.getUncorrelatedIndices() >>> print(uncorrelatedIndices) [0.284905,0.468108] >>> # Get indices measuring the correlated effects >>> print(indices - uncorrelatedIndices) [0.123494,0.123494]

- __init__(*args)¶

- getIndices(marginalIndex=0)¶

Accessor to the ANCOVA indices.

- Parameters:

- marginalIndexint,

, optional

Index of the model’s marginal used to estimate the indices. By default, marginalIndex is equal to 0.

- marginalIndexint,

- Returns:

- indices

Point List of the ANCOVA indices measuring the contribution of the input variables to the variance of the model. These indices are made up of a physical part and a correlated part. The first one is obtained thanks to

getUncorrelatedIndices(). The effects of the correlation are represented by the indices resulting from the subtraction of thegetIndices()andgetUncorrelatedIndices()lists.

- indices

Accessor to the ANCOVA indices measuring uncorrelated effects.

- Parameters:

- marginalIndexint,

, optional

Index of the model’s marginal used to estimate the indices. By default, marginalIndex is equal to 0.

- marginalIndexint,

- Returns:

- indices

Point List of the ANCOVA indices measuring uncorrelated effects of the inputs. The effects of the correlation are represented by the indices resulting from the subtraction of the

getIndices()andgetUncorrelatedIndices()lists.

- indices

OpenTURNS

OpenTURNS